As I wrote before, sometimes I will take the liberty of writing shorter pieces, just to inform the readers of recent changes, usually extremely important and significant. These posts usually are easier to digest, and get better traction but it feels intellectually lazy to me, the main reason I “avoid” them.

Alas, here we are. The most important news is the first one, the second is merely an update on dynamic changes and how sanctions just accelerate changes the weakest link in every chain may bring. Humans are the weakest link.

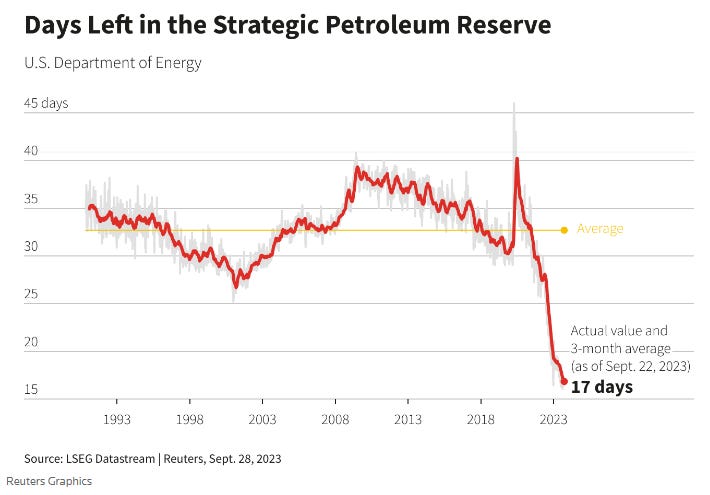

The US SPR finds itself on the lowest levels in over 30 years, with basically 17 days left of reserves.

If you recall the piece about energy, in that piece I cited a news article talking about how absurdly strained US producers and refineries are, running with lower crew, longer hours, close to maximum capacity, and postponing much-needed maintenance, not to talk about updates.

This is easily one of the biggest strategic weaknesses the US has, not just right now, but at any moment in time, the US has no surge capacity (meaning, at a moment’s notice, massively increasing production of X), to add salt to this injury, the Biden administration stated repeatedly it aims at repleting the reserves at the price target of around 64 USD.

Shortly after stating that goal publicly, all OPEC and its allies decided to cut production. The US, and EU have been trying, and clearly failing, at controlling prices, attempting to deter the unabating inflation, leaving their economies and countries very open to exploitative geopolitical moves and hybrid war. Shortly, OPEC will review data and…

Crude has soared more than 20% in three months as alliance leaders Saudi Arabia and Russia squeeze supplies while world fuel demand hits records. The surge threatens to undermine a fragile global economy, harm consumers with another inflationary spike and derail central banks’ plans to wrap up interest-rate hikes.

As I sometimes write, history doesn’t repeat, or rhyme, but it cycles.

As Arthur Burns, the chairman of the Federal Reserve at the time, explained in 1974, the “manipulation of oil prices and supplies by the oil-exporting countries came at a most inopportune time for the United States. In the middle of 1973, wholesale prices of industrial commodities were already rising at an annual rate of more than 10 per cent; our industrial plant was operating at virtually full capacity; and many major industrial materials were in extremely short supply” (Burns 1974). In addition to these cost pressures, the U.S. oil industry had a lack of excess production capacity, which meant it was difficult for the industry to bring more oil to market if needed (Alhajji 2005). Thus, when OAPEC cut oil production, prices had to rise because the American oil industry could not respond by increasing supply. Additionally, non-Organization of the Petroleum Exporting Countries (OPEC) oil sources were declining as a percentage of the world oil industry, and OPEC was therefore gaining a larger percentage of the world oil market. These market dynamics, matched with the effect of OPEC nations’ greater participation rights in the industry, allowed OPEC to wield a much larger influence over the price setting mechanism in the oil market since their formation in 1960 (Merrill 2007).

Western short-sightedness and hubris are setting us up for a lot of unnecessary pain, and loss in the short-term. Oil dictates the global economy, there is no way around it, and as of lately, even organizations that pushed green technology and green “everything” are now seeing the bitter truth. Green energy is expensive, unpredictable, and especially significantly, politically unfeasible.

The second news article I wanted to bring to your attention, is one of the reasons I enjoy and laugh so much at some of the late-stage capitalism dynamics. As I wrote in my semiconductor-centered article, sanctions work, just in reverse.

Key Taiwan Tech Firms Helping Huawei With China Chip Plants

Critics slam Taiwan’s government for inadequate China curbs

Taiwan has pledged to keep advanced tech from Chinese military

Several Taiwanese technology companies are helping Huawei Technologies Co. build infrastructure for an under-the-radar network of chip plants across southern China, an unusual collaboration that risks inflaming sentiment on a democratic island grappling with Beijing’s growing belligerence.

On a scorching summer afternoon in Shenzhen in late August, one vast, nearly-finished construction site established by a Huawei-backed firm buzzed with workers. The dozens of hard-hatted staffers who gravitated toward nearby street vendors couldn’t be told apart except for brightly hued safety vests that bore their employers’ names and official logos.

They included a unit of Taiwanese chip material reseller Topco Scientific Co. and a subsidiary of Taipei-based L&K Engineering Co., according to a Bloomberg News investigation. Across town at another Huawei-affiliated site, Bloomberg identified workers from a subsidiary of construction specialist United Integrated Services Co.

Meanwhile, Taiwan’s Cica-Huntek Chemical Technology Taiwan Co. said on its website that it had won contracts to build chemical supply systems for two Chinese chipmakers — Shenzhen Pensun Technology Co. and Pengxinwei IC Manufacturing Co., which was blacklisted by the US last year. Both companies have been identified as working with Huawei to build chip fabrication facilities. The company removed the online reference after Bloomberg News inquired about it.

The previously unreported Taiwanese presence in Huawei’s efforts risk triggering a backlash on an island that is preparing for polls next January, with the question of Taiwan’s rocky relationship with China likely the most pivotal issue.

I see a near future where the systemic smuggling of advanced tech is a profitable, and massive business, and so will be “smuggling” code, and AI’s, industrial espionage at a level not seen before. In case you thought “Man, that is just too crazy even for you”, well, it is already occurring with GPUs, and the destination right now is China.

In the US, a gray market exists, where “normal” people, with enough money or investment, use third parties who possess incredible networking in the semiconductor field to acquire these expensive, AI-centered GPUs (Tony is one of these guys), in this particular case, it is done because of supply issues and fear of government regulating the possession and usage of GPUs or GPU clusters.

Tech war: strong demand in China for advanced chips used on AI projects creates growing market for smuggled Nvidia GPUs, despite US ban

The under-the-counter trade has prospered, despite a US ban imposed last August on the sale to China of certain products from AMD and Nvidia

One vendor claimed he was he was able to source Nvidia’s A100 GPU and charged US$17,709, which is above its suggested retail price of about US$10,000

If anything, the future will surely be interesting.

Buy honey and peanut butter

The graph is from Sept 28. So the Israel conflict was started with only 7 days of reserves left.

Last minute emergency actions….