A good song to read this article.

It has been a good few days. For the first 10 days of the year I have been focusing on the scientific side of my writings, and research does take time, partial reason for the radio silence, the other half of the reason was… nothing much happened, unlike other years, were certain events that took place in the first 2 weeks of January dictated much of the geopolitical tone of half of the year. Somewhat diverging from the trend of the last 4 years, for better or worse.

Well, that was a little bit of obfuscation, something did happen. Iran-backed Houthis kept disrupting the flow of global commerce in the Red Sea. But there are many other events worth consideration, which I intend to cover today.

As I wrote late last year, the Red Sea disruption would not only persist but escalate, the economics of hybrid warfare and overall geopolitical “misalignment” make a lot more sense for Iran to persistently use its proxy forces in Yemen to cause havoc in our globalized economies. From both true economical cost, cheap drones vs very expensive modern, long manufacturing times munitions, to one of the actual end goals. Economic shocks in many fragile parts of our economies.

Shortly after publishing my last article, the US government announced it was launching “Operation Prosperity Guardian”, and at every step of the way it was faced with opposition, both from home and from abroad because, in the age of hybrid warfare, war is not just kinetic, the physical aspect of warfare is now merely one side of the dice, serving one of the main goals of modern conflict. Narrative warfare will play larger and larger roles in how the world functions, and how governments respond to a myriad of events as the cascades reverberate.

Just a few days ago the US and the UK Navy stopped over eighteen drones, two cruise missiles and one ballistic missile were shot down by F/A-18 warplanes. For a perspective cost, a drone will fetch 20.000 USD to produce, and the missiles used by the UK HMS Diamond cost 1.3 million each. The response towards the aggression and disruption of goods in one of the most important maritime choke points was inevitable, yet it solidified all the events that were about to unfold.

The US hit Houthi targets in Yemen, prompting the Houthis to say they will respond in kind. Not doing anything isn’t an option, and doing something will also cost the Western and potentially the global economy, there is a real, tangible risk beyond just extrapolation of a continuous spillover of conflict in the Middle East. Because make no mistake, these events were in response to the Israel-Palestine war, using it as an excuse or not, it is a fact.

Maerks chief can now clearly see how events may unfold, where this game of expensive cat and inexpensive mouse may last a long time. It is a fairly decent strategy for Iran to keep puppeteering their proxy army into disrupting the region every few weeks, inducing persistent inflationary pressure in the global economy struggling for recovery, while also avoiding a substantial response since there is a massive lag between each potential future attack.

Another point I raised since the inception of this publication was that many of the largest and medium-sized companies made the mistake of not learning their lessons in the last 3 years, and going back to the Just-In-Time model, a logistical model where you never have a sufficient buffer in stock to produce your product because new stock arrives “just in time”.

Just a few weeks of what one could consider “mild disruption” and both Tesla and Volvo in Europe are already suspending production of their plants because they are already experiencing shortages of components. Target also is facing some level of disruption. Container and insurance rates are skyrocketing, but nowhere near 2020 (yet ?). Spot rates are exponentially increasing.

Many forms of logistical contracts are done in two forms, long-term contracts or “spot market”, long-term contracts are often cheaper, because you secure the rate (cost) at the moment, avoiding any market ups and downs. The spot market is dictated by many variables, and if the contracted ships are making fewer trips, it means more trips end up in the spot market. Here the threat of disruption is as a effective hybrid weapon as disruption itself.

In the words of the World Bank.

“Conflict escalation could lead to surging energy prices, with broader implications for global activity and inflation.”

An interesting factoid before going further is the fact that many ships in the Red Sea region are changing their AIS (automatic identification system) to say “China ship” as a means to avoid being targeted. So far no Chinese ship has been targeted. And China COSCO (largest shipping company) suddenly stopped any trips to Israel…

With this Iran achieved success in securing goodwill with some of its neighbors, domestically slowly pressuring the global economies, and shifting alliances and interests. Iran and other Western adversaries won’t need much effort in the narrative front to such dissatisfaction among the population, Western government’s stupidity and bad choices since 2020 already made sure of that. A perfect example is the economic motor of Europe, and also an example of self-destructive policy.

For the best part of the last week, farmers around Germany have been protesting the government’s decision to cut diesel subsidies to farmers, which is what some of them say is the straw that broke the camel’s back. As I forecasted over a year ago, revolt is one of the most pernicious, self-spreading, and viral memes (genes of culture). Every time European governments make a short-sighted decision to go green, at the cost of their weakening, non-competitive economies, they are and will be faced with revolt.

On the bright side, Europe’s energy situation, even with disruption in the Red Sea, and snags elsewhere has been good, as a narrative pushed by EU-centric government, it has been lauded they are now finally off the Energy Crisis, it is the past, the future looks bright. Right ? As the US bought quite a few million barrels of oil from Russia, among other raw materials, Europe traded its cheap energy dependency on Russia, to buying expensive energy elsewhere, to in the end…

Become dependent on Russia for fertilizer. Another source.

Yara CEO Svein Tore Holsether says Russia is using food and fertiliser as weapons. Europe is more food dependent on Moscow now than we were before the war, he says. The bloc is replacing energy dependency with fertiliser dependency, he adds. He calls for incentives for farmers to make environmentally-friendly choices.

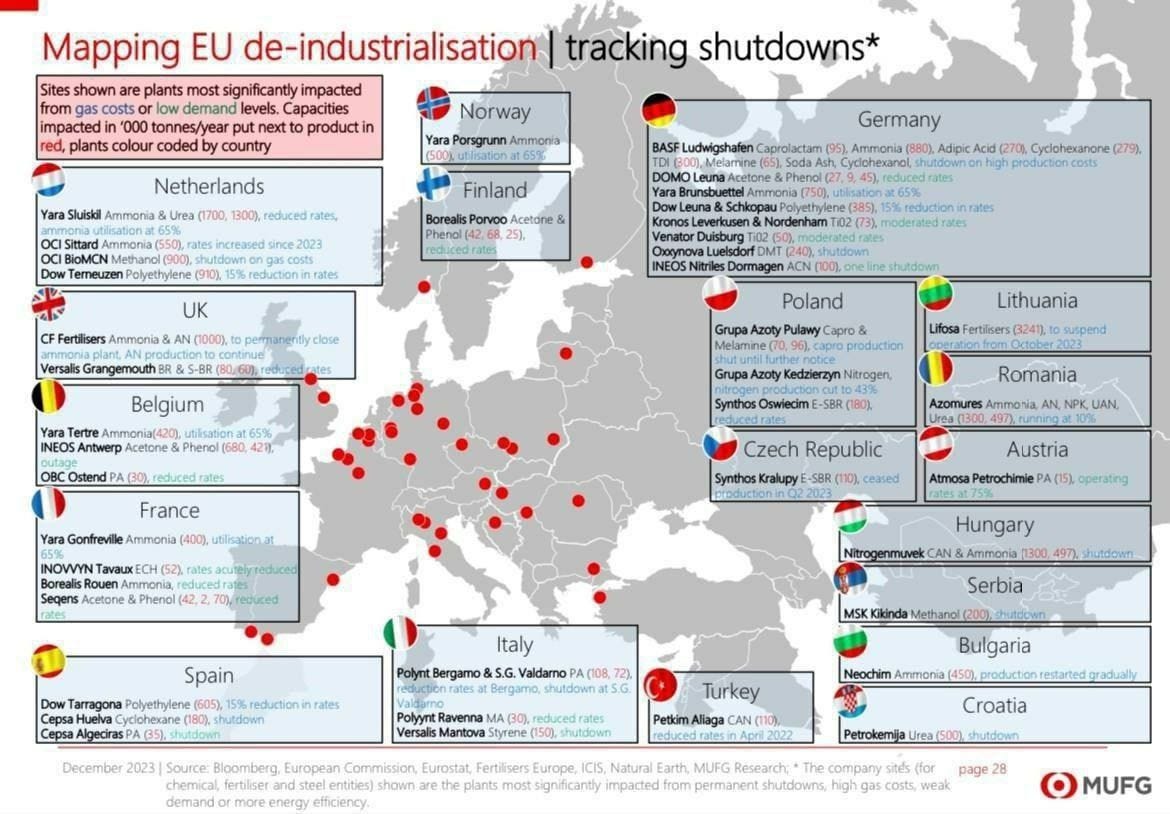

If a picture is worth a thousand words, here is a picture of the European loss of fertilizing plants.

Two of the 3 biggest economies in Europe are now subsidizing their industries to attempt to halt or slow down deindustrialization. And repeating myself again, this is merely a short-sighted, short-term half-measure to correct mistakes made by themselves, and these incentives end up fueling the very thing the economies are fighting.

If my memory was in a bad state, I would ask myself or my readers, perhaps multiple times, if we are living in The Matrix and we are glitching, or if we are living in a quantum loop. Because one way or the other, with small alterations, they are repeating the same mistakes. Or I can use one of my favorite memes.

As we enter 2024 we find ourselves in a fractured system, with pressured building everywhere, sometimes at once, and while the recovery was present, measurable, and real in many parts of our globalized system, the system itself is still weak, prone to disproportionate damage from “black swans” or even cygnet swans (events that become black swans).

While I personally think there is room for positivity, I wouldn’t lie to say we are in for a nice, calm, rose-tinted year, but we will persevere regardless. Repeating myself, while many of the dynamics changed, outcomes remains the same as before. Logistical disruptions are the most important matter to keep an eye on, given the absurd pressure they can put on the weak global economy, and push from a difficult, low-growth state, to an inflationary spiral…

And you should remember we now live under the age of language-models, and narrative will bend towards wherever one dedicates enough compute and talent towards.

And since I am now abstaining from fluff for the sake of engagement and clicks, at the cost of “growth”, I will insert the following articles here. See these as separated from the central theme here.

OPENAI QUIETLY DELETES BAN ON USING CHATGPT FOR “MILITARY AND WARFARE”

The Pentagon has its eye on the leading AI company, which this week softened its ban on military use.

OPENAI THIS WEEK quietly deleted language expressly prohibiting the use of its technology for military purposes from its usage policy, which seeks to dictate how powerful and immensely popular tools like ChatGPT can be used.

Up until January 10, OpenAI’s “usage policies” page included a ban on “activity that has high risk of physical harm, including,” specifically, “weapons development” and “military and warfare.” That plainly worded prohibition against military applications would seemingly rule out any official, and extremely lucrative, use by the Department of Defense or any other state military. The new policy retains an injunction not to “use our service to harm yourself or others” and gives “develop or use weapons” as an example, but the blanket ban on “military and warfare” use has vanished.

It shouldn’t be a surprise if you are paying attention. The US government and agencies can’t compete, and can’t create models as sophisticated as the private sector, even adopting the same architecture, and having good talent.

To me, it is becoming increasingly harder to consume any content, from almost anywhere. Language model usage has been “plaguing” content creation, from merely using it to make some changes or bridge knowledge gaps, such as scientists using ChatGPT to write easier-to-understand introductions and sections of their papers, to whole articles. I can only imagine when narrative warfare at an industrial scale comes…

I appreciate the support and the patience, and ask you for a little more patience. I rather take longer than write meaningless articles, and I need to tinker away on my essays after I tackle a few complicated subjects in the other publication. If anything worth noting occurs, I will be sure to write about it.

Oh I almost forgot. Multiple oil tankers suddenly combusted in New Hampshire yesterday. Perhaps Accident season is once again upon us.

The media often telegraphs potential geopolitical movements, guess what is the talk of the town this weekend ? The costs of a Taiwan war…

awesome article. i started my own business shortly before covid and one of the reasons i started it was 80% of my job in my multinational was fixing fuck ups related to just in time.

I think supply chain is going to be a big issue this year but also, and since i guess you still live in brazil, you might not be seeing it as much as in europe. the shear amount of incompetence of the people you need to deal with on a day to day basis is getting far worse. so many things don't work now. my friend who is very high up in IT blames most of the "due to technical difficulties " issues we see as being down to sending all the IT to india.

even things like whatsapp or FB are far worse and buggy than 5yrs ago.

Did you happen to seen the U.S. naval fleet being handcuffed with inability to source parts for repairs in a timely manner?